GO Fashion (india) limited share price

GO Fashion company was incorporated in september 9 ,2010 as a private limited company under the company Act 1956 and was granted a certificateof incorporation by registrar of companies , tamilnadu at chennai .

|

| image courtesy - gofashion e-commerce websites |

New Update -

Listing Price of Go Fashion - Rs. 1316 with 629 point listing gain nearly 90.72 % return

About the company

Go fashion (india) ltd. women's bottom ware brand in india ith a market share of approximately 8% in the braded women's bottom wear market in fiscal 2020 The company manages it products under the the product name " colous " it is the first company to launch a brand exclusively dedicated to the women's wear category .

Go fashion limited has seven directors - SHRINIVASAN , SHRIDHAR , DINESH , MADANLAL GUPTA , AND OTHERS

Promoters of the company :-

Promoters are prakash kumar saroagi , gautam saroagi , rahul saroagi , PKS family VKS family

About the Promoters :-

Prakash Saroagi - MD of the company since march 2011 . Work is stratgic planning .

Education - AC college of technology (b.tech) Chemical engineering A grade

prash saroagi is registerd with ministry of corporate affairs . their DIN no. is 00496255

Competitors of GO fashion :-

1. future lifestyles fashion (FLF) is a retailer of apparels

2. Vajor is provider fashion and lifestyles products .

3. HATCH is company that produces collection of essentials wear before , ing and after preganancy .

4. Page industries is an india manufacture and retailer of innerwear , lounge wear and socks It is exclusive licensee of jockey international india ,shrilanka , nepal , bangladesh , united arab emirates , oman and qatar . in 2011 it is licensee of SPEEDO swimwear from pantlandroup of india and shrilanka .

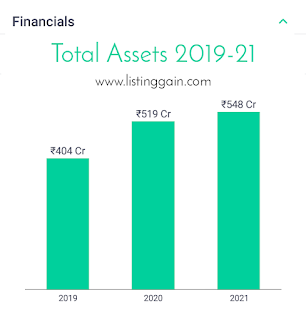

Financial -

Strengths & Risks :-

+ GO fashion is a leading women's bottomwear brand in india with a well diversified products portfolio like churidars, leggings , dhotis , harem pants, trousers , patiala , palazos , culottes , pants , jegging and more .

+ multichannel pan india distribution network with a focus exclusive brand outlets (EBOs) that enhance the brands visibility .

+ Standerised and scalable development model for its EBOs based on its know how and experience and an efficient operating model .

+ extensive procurement se with highly efficient and technology drivan supply chain management .

+ in house expertise in developing d disigning products .

+ demonstrated track record of strong financial rformance .

RISKS :-

- Inability to effectively market its product and and or any deterioation in public perception of its brands GO Colours .

- incured losses in fiscal year 2021 .

- risk associated with location of its exclusive rand outlets (EBOs)

- EBOs operates n leased properties and any change in the real estate rental market can adversely affect its profitability .

- while the company have stores across the country , its majorly concentrated in south and west india .

- Go fashion india limited operates out of single warehouse in south india .

- inability adequately protect its trademarks or its iltelectual property right

- inability to effectively manage or expand its retail network .

- inability to participate and respond to changes fashion trends d changing customer preferences in a timely and effective manner .

Object of Listing :-

The deployment of funds has not been raised by any bank or financial institution . while the company proposes roll out 20 new EBOs pan india , its is not identified cations for setting up of such new EBOs . the location of such EBOs will be decided by company based on its business plan management estimates and market conditions .

Market preview :-

India apparel market v/s global

while china and usa are the largest markets nd india is the third largest apparel market in the world sharing in position with japan and germany in terms of value .

India appaerel market size

Apparel market size in fiscal 2021 is 447.666 crores and expands to grow at a CAGR of aproximately 8.95% etween fiscal 2020 and 2025 to reach 687.263 crores by 2025 on the back of factors like higher brand conciouness , increasing digitaliasation , great purchasing power and increasing urbanisation .

IPO Details :-

bidding date - 17 nov - 22 nov 2021

Face value - 10

minimum investment - 13755 Rs

minimum share - 21

lot size - 21

Issue size - 1014 crore

listing date - 30 november 2021

Subscribed - 49.39 times in retail market

Subscription Rate :-

Retail individual invester - 49.39x

non - institutional invester - 262.08x

qualified institutional buyers - 100.73x

Registrar of the company -

KFIN technologies private limited

(formarly knowns as karvy fintech private limited )

E-mail id - gofashion.ipo@kfintech.com

Website - www.kfintech.com

Contact person - M. MURLI KRISHNA

sebi registratrion - INR000000221

Address - selenium tower Bplot no. 31 and 32 financial district , hydrabad , Telangana INDIA ...

Company contact information -

Email ID: actsmain@gocolors.com

Website: www.Gocolours.com

Address:

SATHAK CENTER, 5TH FLOOR NEW NO.4, OLD NO.144/2, NUNGAMBAKKAM HIGH ROAD, CHENNAI Chennai TN 600034 INDIA

Lead Managers

1. ICICI Securities

2. Edelweiss

3. SBI Capital market limited

Frequently Asked Question

Q. What is an IPO ?

IPO or Initial public offering is a way where company want to raise sum amount of money for their business expansion, paying debt, etc. It is a process where private limited company convert into public limited company which is traded publicly in Stock exchanges like Bombay stock exchange and national stock exchange.

Q. Who decides the price of IPOs ?

Company decides the price of IPO with the help of Lead mangers. Sebi or stock exchange does not interfere in the price of IPOs . There is risk in decide best and suitable premium rate for IPOs because investors do not like higher premium rates.

Q. Who will decides dates of IPO or listing date ?

Once SEBI and Stock exchanges approved for IPO then company cunsult with lead managers or registrar , stock exchanges to fix the date.

Q. What is the Role of Registrar ?

Basis work of Registrar are to provide facility like transfer stocks to investor demat accounts, transfer refunds in the investor account who do not get IPO and they are registered with SEBI and Stock Exchanges.

Q. Is it mandatory to have PAN number to apply for IPO ?

YES, since july 2006, SEBI made PAN compulsary for IPO applicants.

Q. How many times One person apply ?

Only one time a one person will be applied but you apply for IPOs from your family's account.

Q. How IPOs listing price is decided ?

The listing price of IPO is decides through book building by syndicate of investment banks.

Q. One can apply for IPO for Offline ?

Yes, you can apply for IPO offline.

Q. How many days IPOs subscription open ?

At least 3 working days IPO will be open for subscription.

Q. What is 'market lot' or 'Minimum order quantity' ?

When a company launches a IPO , company decide, how many numbers of shares that an investor can get .

Q is it mandatory trading account apply for IPO ?

No, it is not mandatory for trading account.